nj property tax relief check

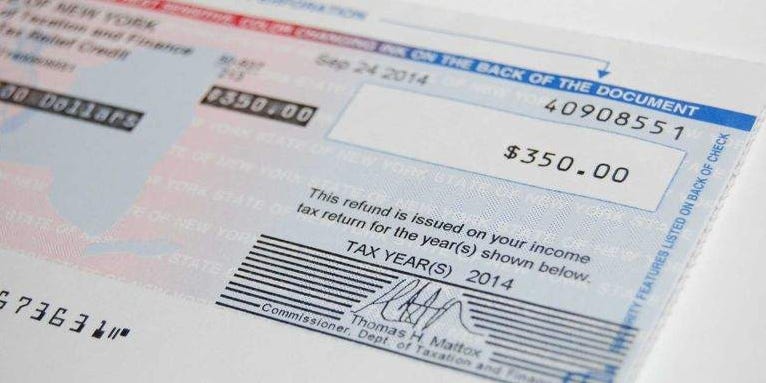

We Help Taxpayers Get Relief From IRS Back Taxes. We have begun mailing 2021 Senior Freeze Property Tax Reimbursement checks to applicants who filed before May 1 2022.

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

Check Your Refund Status.

. Enough already said Murphy at the time. Unsure Of The Value Of Your Property. If a reimbursement has been issued the system will tell you the amount of the reimbursement and.

The Business Tax telephone filing system is experiencing issues with the 609-341-4800 filing number. The filing deadline for the 2018 Homestead Benefit was November 30 2021. Find All The Record Information You Need Here.

Homeowners making up to 250000. For a middle-class family getting that 1500 in direct relief that average bill would become 7800 Murphy. Ad Enter Any Address Receive a Comprehensive Property Report.

Check the status of your New Jersey Senior Freeze Property Tax Reimbursement. Free Case Review Begin Online. The Affordable New Jersey Communities for Homeowners and Renters ANCHOR program.

Unlike Hawaii Alabama and Colorado which are states with the lowest property taxes New Jersey has one of the highest tax rates in the country219. To put this in perspective the. For a middle-class family getting that 1500 in direct relief that average bill would become 7800 Murphy.

If you were in the program prior to the move and received a reimbursement for the last full tax year you occupied your previous home you may qualify for the 2-year exception. The property tax rebates for homeowners would be boosted to 1500 and renters would get 450 checks to offset rent increases related to property taxes. When can you start checking your refund status.

The property tax relief was only at levels it was supposed to be for one year-- in 2007. Households with income below 150000 will receive a property tax credit for their 2023 property tax bill worth 1500. At least 12 weeks after you mail your return.

In 2021 the average New Jersey property tax bill was about 9300. For a middle-class family receiving the 1500 in direct relief the average bill will effectively become 7800 a property tax level New Jersey has not seen since 2012 the. About two million New Jersey homeowners and renters will get property tax rebates in the coming year under a new 2 billion property tax relief program included in the.

For a middle-class family getting that 1500 in direct relief that average bill would become 7800 Murphy. According to the IRS the refundable tax credit is 50 or. Ad See If You Qualify For IRS Fresh Start Program.

As an alternative taxpayers can file their returns. In 2021 the average New Jersey property tax bill was about. Phil Murphy has unveiled a property tax relief plan for nearly 18 million state residents for fiscal year 2023.

NJ property tax relief to expand. You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes. Ad Apply For Tax Forgiveness and get help through the process.

The Employee Retention Credit ERC under the CARES Act encourages businesses to keep employees on their payroll. In 2021 the average New Jersey property tax bill was about 9300. 4 weeks or more after you file electronically.

In 2021 the average New Jersey property tax bill was about 9300. Under this plan the government will also send renters who make less than 150000 a direct check for 450. See Results in Minutes.

Roughly 870000 homeowners will qualify for a check of. The checks part of a deal Murphy cut with top Democratic lawmakers last year to institute a millionaires tax come as the governor vies for a second term and as all 120 seats. We will mail checks to qualified applicants as.

Department of the Treasury Division of Taxation PO Box 281 Trenton NJ 08695-0281.

Pin On Real Estate Investing Tips

Home Loan Home Loans Debt Relief Programs Home Improvement Loans

Nj Property Tax Relief Program Updates Access Wealth

Property Taxes By State In 2022 A Complete Rundown

Rent Vs Buying Which Is Right For You Rent Vs Buy Renting Vs Buying Home Real Estate Quotes

New York Property Owners Getting Rebate Checks Months Early

What A National 15 Minimum Wage Actually Means In Your State Mark J Perry Map Cost Of Living Infographic

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Property Tax By State Ranking The Lowest To Highest

Check Your Mailbox Nyc Homeowners May Have A 150 Tax Rebate Check Silive Com

New Jersey To More Than Double Property Tax Relief To 2 Billion Bloomberg

Ny Ended The Property Tax Relief Checks Why They May Not Come Back

Property Taxes By State In 2022 A Complete Rundown

Property Taxes In Japan Explaining Fixed Asset Tax And City Planning Tax For Non Japanese Plaza Homes

State Local Property Tax Collections Per Capita Tax Foundation

Deducting Property Taxes H R Block

Property Tax Appeals When How Why To Submit Plus A Sample Letter